Ensuring Tax Compliance Using A Payroll Management System

Payroll Management System

When you think about payroll tax compliance, you usually think of legislative changes. Withholding computations is also a crucial component of tax compliance. It poses a challenge for even the most experienced payroll and HR experts. A robust payroll management system can enhance your operational capacity.

The legal and regulatory compliance landscape is ever-changing.

Such a scenario makes it difficult for businesses to comply with labour and tax rules. Furthermore, each industry in India has its laws and regulations. In addition, non-compliance with these laws can result in significant fines and legal action.

Table of Contents

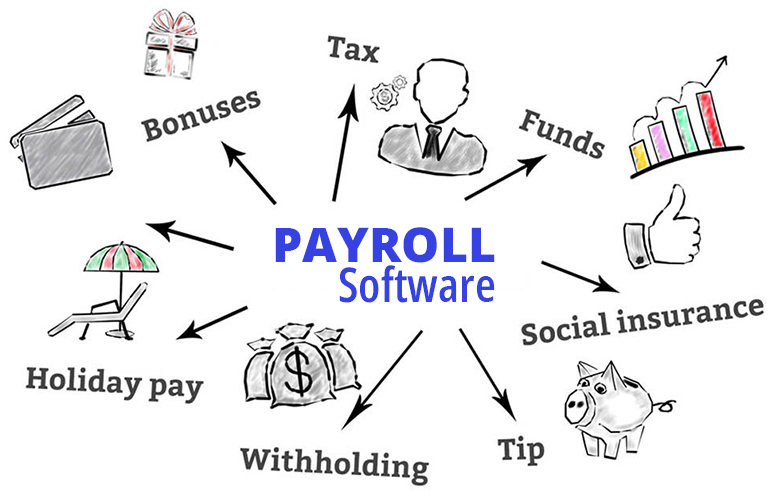

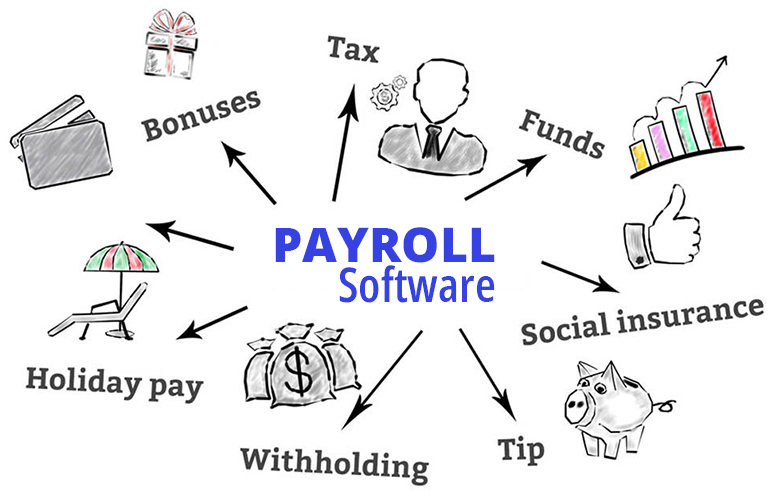

Managing the Elements of Payroll Processing

There are numerous payroll components, such as CTC, Basic, HRA, TA, DA, EPF, Income Tax, Form-16, and others. It is very crucial to recognize a minor detail to stay compliant. It would be best if you avoided such a circumstance at all costs.

The solution to this problem may reside with an HRMS Platform. A payroll management system handles all compliance updates for your business. It also guarantees that your company is constantly in compliance with payroll legislation.

Payroll management tools allow HR professionals to calculate taxes that should be deducted from an employee’s income. It also allows them to calculate payables after mandatory tax deductions.

In India, What Exactly is Payroll Compliance or Statutory Compliance?

In layman’s words, statutory or payroll compliance refers to the rules and regulations established by the federal and state governments. It includes all labour and taxation laws for an organization to remain tax compliant.

These payroll compliance requirements protect employees, employers, and the firm. Statutory compliance includes the following items:

- Shops and Commercial Establishments Act (S&E)

- The Employees Compensation Act-1923

- The Trade Unions Act of 1926

- The Payment of Wages Act-1936

- The Industrial Employment Act 1946

- The Industrial Disputes Act of 1947

- The Minimum Wages Act-1948

- The Employees State Insurance Corporation Act – 1948

- The Factories Act of 1948

- The Employees Provident Funds ((EPF) and Miscellaneous Provision Act – 1952

- The Employment Exchange Act-1959

- The Apprentice Act, 1961

- The Maternity Benefit Act of 1961

- The Industrial Establishment Act 1963

- The Payment of Bonus Act 1965

- The Labour Welfare Fund Act (LWF) 1965

- The Contract Labour Regulation & Abolition Act (EPF) – 1970

- The Payment of Gratuity Act 1972

- The Professional Tax Act (PT) 1975

- The Equal Remuneration Act-1976

- The Interstate Migrant Workmen Act, 1979

- The Child Labour, 1986

- Sexual Harassment of Women at Workplace Act

Any business, regardless of size, must follow these regulations. They must interact with their employees within this legal framework. All businesses that hire and pay employees must follow these labour rules.

Labor law violations can result in penalties, fines, litigation, and other legal action. Statutory compliance is complex. A corporation must be well-versed in these laws to ensure compliance during its operations.

The regulatory landscape is constantly evolving. Payroll management tools can assist organizations in remaining compliant. They ensure that businesses stay on the right side of Indian law.

What Happens If You Break the Rules?

Non-compliance with state and federal laws can have serious consequences. You may find yourself in legal jeopardy in such a case. If a firm fails to comply with statutory laws, it may face penalties, legal action, and reputational harm.

Fines and Penalties

Penalties are one of the most typical outcomes of law non-compliance. Non-compliance with statutory norms and regulations can result in a variety of penalties. Penalties include significant fines, jail time, and audits.

In difficult situations, it may also be a justification for the facility’s closure. However, the severity of the punishment is determined by the severity of the non-compliance. The government defines these penalties imposed on any business.

Reputational Harm

Any business’s reputation is irreplaceable. Non-compliance with statutory laws might jeopardize that reputation. It may also lead to a loss of confidence and integrity.

Failure to follow statutory laws and regulations may cause consumers, employees, and other stakeholders to question the company’s legitimacy.

Furthermore, a criminal conviction for non-compliance may be devastating for any firm. Failing to comply can result in a public uproar, a drop in share prices, or poor thoughts about the organization.

A Scarcity of Opportunities

A damaged reputation in a highly competitive environment puts a corporation at a disadvantage. Furthermore, firms may be prohibited from conducting business in specific industries. This may result from restrictions or sanctions, resulting in lost opportunities.

Licence Cancellation or Suspension

To operate a business, you must obtain licences. Non-compliance with statutory laws and regulations can lead to licence termination or suspension.

Loss of Current and Potential Employees

No employee wants to be linked with a company that fails to comply with statutory laws. You may view them as unstable and untrustworthy. As a result, employees may opt not to work for such organizations.

Furthermore, potential employees view non-compliance, payroll concerns, and so on as red flags. Such a scenario makes it difficult for businesses to discover and retain talent.

Liabilities, both Civil and Criminal

Statutory non-compliance can result in civil or criminal lawsuits against business owners and other top management, depending on the severity of the statutory law violation.

What Are Your Organization’s Responsibilities?

Every organization is responsible for adhering to various statutory rules. These rules range from timely and accurate payroll to employee fairness. Furthermore, a corporation must follow the rules to avoid the exploitation of employees at all levels.

An organization’s responsibilities include timely tax payments and adhering to a prescribed set of laws and regulations. They must do this to remain compliant and always be on the right side of the law.

How Do Payroll Management Systems Make Sure Their Clients Are Compliant With Payroll Laws?

In today’s competitive market, sophisticated payroll processing solutions are required for businesses to remain compliant with rules.

Payroll management tools have technologically advanced platforms to assist with numerous federal and state employment regulations and labour norms. They also assist clients in adhering to compliance. This practice helps their firm avoid legal disputes.

Dealing with the law requires businesses to be well-versed in various payroll compliance standards and regulations.

A payroll management system ensures hassle-free statutory and payroll compliance. They provide a robust payroll management system, an HR and leave management system. Furthermore, they deliver fast and accurate payroll processing and tax payments.

These practices are critical for remaining compliant and avoiding legal issues. The best payroll software lets businesses automatically manage TDS, professional tax, ESIC, EPF, etc. An HRMS Platform’s payroll processing technology is both robust and scalable.

It enables organizations to generate forms and capture challans to manage all regulatory and payroll compliances efficiently. They help firms handle complex wage structures on a uniform platform. It also conveniently manages factors such as CTC proration and tax management.

Furthermore, the best payroll software will assist organizations with the following:

- Validation of the PF register the preparation

- Uploading and generation of challan sheets

- The remittance of PF checks

- The processing and submission of PF forms following validation,

- The filing of statutory returns within the statutory timelines.

A Reliable Payroll Management System Provider

ConfluxHR is a significant payroll management software that also provides HRM services. They help businesses stay compliant by simplifying payroll. They also handle payroll difficulties and compliance for their clients, so they don’t have to.

Furthermore, their payroll management tools ensure that payroll is processed on time and accurately, whether on-time payroll processing or statutory filings, reporting and analytics, or expenditure management, their payroll processing solution automates the entire workflow.

Instead of expecting you to modify your organization’s system to match theirs, their payroll management solution is built to work with your existing processes and systems. Their extensive services set them apart from the competitors, and they include:

- A Full spectrum of services – from Recruitment to Exit Process Management

- An extensive range of reporting and system options that you can expand into leave and attendance management, performance management, expense management, and HR systems.

- Ensures complete compliance and satisfies all legislative and legal reporting requirements.

- Real-time access through web platforms.

Conclusion:

Payroll might be complicated. As you can see, there are several things you must do to be compliant. You’ll have the best chance of staying compliant with your payroll if you use a reliable payroll software.

You may also remain updated on law changes through training, webinars, and seminars. A payroll processing business will assist you in avoiding penalties and legal action. It will ensure that your business follows all payroll compliance obligations.